Qualified Business Deduction 2024 Application

Qualified Business Deduction 2024 Application – Ready or not, the 2024 deduction. Bonus depreciation, implemented by the Tax Cuts and Jobs Act (TCJA) in 2017, allows business owners to write off a large percentage of the cost of a qualified . As 2024 has just begun To create a benefit for the owners of those business entities, a qualified business deduction provides up to a 20% deduction on the pass-through earnings of a qualifying .

Qualified Business Deduction 2024 Application

Source : optimataxrelief.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comSanta Ana businesses can receive up to $5,000 with our Small

Source : www.santa-ana.orgA Guide to the QBI Deduction | Castro & Co. [2024]

Source : www.castroandco.comSanta Ana businesses can receive up to $5,000 with our Small

Source : www.santa-ana.orgQualified Business Income Deduction (QBI): What It Is NerdWallet

Source : www.nerdwallet.comSanta Ana businesses can receive up to $5,000 with our Small

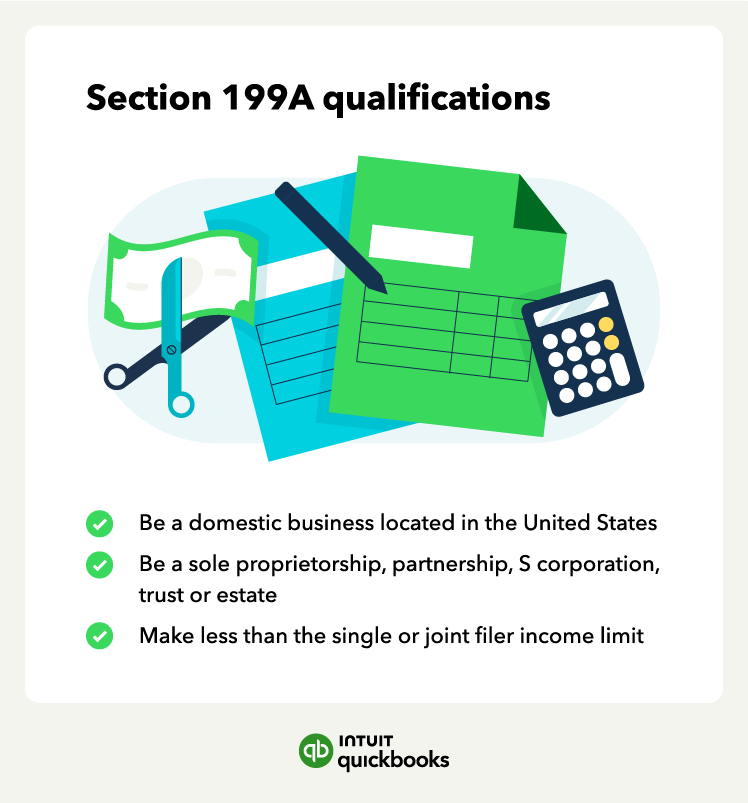

Source : www.santa-ana.orgSection 199A deduction explained for 2024 | QuickBooks

Source : quickbooks.intuit.comWhat is the Qualified Business Income Deduction? | Optima Tax Relief

Source : optimataxrelief.comFour Year End Tax Moves for Businesses | Miller Cooper

Source : millercooper.comQualified Business Deduction 2024 Application What is the Qualified Business Income Deduction? | Optima Tax Relief: While smaller businesses can benefit from using QuickBooks, the platform’s ability to help businesses calculate tax deductions software with third-party applications, QuickBooks’ 750 . up to $5,000 annual deduction for individuals ($10,000 for married couples filing jointly) Fees: No enrollment, application or maintenance fees; program management fee of 0.13%, including expenses .

]]>